Housing Down Payment Assistance Program

Down Payment Assistance Program in Saint Petersburg, Florida

ask us anything!

Got questions? We're here to help! Whether it's about mortgage rates, plans, or the process, feel free to ask us anything. We're ready to guide you every step of the way!

(727) 642-1166

get Pre-Qualify

Get Your Personalized Mortgage Quote Today!

xUnlock Your Dream Home with Our Mortgage Solutions.

20+

20+

Year of

experience

Who we are?

Your Trusted Partner in Home Financing & Down Payment Assistance!

Are you dreaming of owning a home in Saint Petersburg, Florida, but need help with upfront costs?

Generation Mortgage Associates, a trusted mortgage company specializing in Down Payment Assistance, is here to guide you through accessing the City of Saint Petersburg's Down Payment Assistance Program.

This program provides financial support to make homeownership more attainable for qualifying buyers by the City of St Petersburg.

As a mortgage company we will process your application for the Down Payment Assistance from the City of Saint Petersburg and provide an FHA or Conventional Loan (depending on your credit score).

NOTE: The program for Down Payment Assistance from the City of Saint Petersburg, do not work directly with the buyers. Therefore, Generation Mortgage Associates as qualified mortgage company process your application with the City.

ABOUT THE PROGRAM

The Housing Down Payment Assistance Program offers eligible homebuyers a secondary mortgage with 0% interest, providing up to 20% of the property’s sales price, plus $5,000 for closing costs, with a maximum loan amount of $75,000. This program is designed to help families and individuals achieve their dream of homeownership while maintaining affordability in Saint Petersburg.

We specialize in down payment assistance programs and mortgage loans.

Personalized mortgage solutions tailored to your needs.

Expert guidance throughout the entire buying process.

Competitive rates to help you save on your monthly payments.

what we offer ?

We specialize in down payment assistance programs and mortgage loans.

We streamline the mortgage process to make your homeownership dreams a reality. Our tailored solutions and expert support ensure a smooth journey, empowering you to achieve your goals with confidence.

Loan Terms

Housing down payment assistance is provided in the form of a 0% interest, secondary mortgage. Therefore, does not affect the DTI or Debt To Income.

Loan Amount: Up to 20% of the property’s sales price, plus $5,000 for closing costs, with a maximum total of $75,000.

Forgiveness: Loans for homebuyers at or below 80% of the Area Median Income (AMI) are 100% forgiven after 10 years of continued occupancy.

Repayment: For those earning 81%-140% AMI, affordable repayment begins one month post-closing, except for homes located in the South St. Petersburg Community Redevelopment Area.

Eligibility Requirements

Before applying, buyers must meet the following criteria:

Financial Contribution: Contribute at least 1% of the sales price.

First-Time Homebuyer Education: Complete an 8-hour HUD-approved educational training class and receive a certificate of completion.

Property Location: The home must be within Saint Petersburg’s municipal boundaries. Verify the location using the Pinellas Property Appraiser website. The tax district should be listed as “SP.”

Inspection: The property must be inspected by a licensed home inspector, with all deficiencies addressed before closing.

Income Limits: Household income must not exceed HUD's maximum annual income limits based on household size.

Maximum Housing Price

The program applies to homes with a maximum purchase price of $510,939.

Income Eligibility

Eligible income includes:

Salaries

Child support and alimony

Social security and pensions

Public assistance

Income-producing assets

Other income sources

Income limits vary by household size. You must include the entire household income.

Example: If you have 3 people (of any age) your income can't exceed $68,800

Does your income exceeds the 80% AMI?

The city is over the spending limit for applications over 80% AMI, so applications between 81% AMI and 140% AMI may be limited.

If the property is in the South St Petersburg Community Redevelopment Area, it may be funds available, please, inquire.

Benefits of the Program

Affordable Homeownership: Reduced upfront costs make owning a home more achievable. Educational Support: Gain valuable knowledge through a HUD-approved training class. Generous Loan Terms: Enjoy 0% interest and potential forgiveness, depending on income and occupancy.

how it works

Application Process

Consultation

Discuss your needs and financial goals with our experts. Call (727) 642-1166.

Application

Complete a simple application to start the financing process.

Closing

Finalize your mortgage and receive the keys to your new home!

Super Simple 3 Step Process

How is your credit?

The Down Payment Assistance (DPA) program does not have a specific credit score requirement. However, FHA or Conventional loans require a minimum mid-credit score of 620 for all applicants. We receive numerous applications daily, so it is essential for you to authorize and pull your own credit report. Use the link below to pay for and access your credit report.

Apply

After pulling your credit report, click the button below to complete the application. This step is crucial for us to verify your employment and other necessary information.

Provide Documents

Provide your latest income documents: 30 days of pay stubs, 2 years of W-2s, or, if self-employed, 2 years of tax returns. This, along with your credit report, helps us determine your eligibility and loan amount for your home purchase.

Testimonials

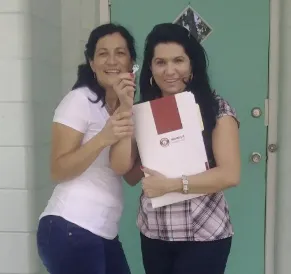

— Kirenia Milan and Keyla Milan

Congratulations to Kirenia Milan and Keyla Milan for the purchase of their new home Saint Petersburg, FL 33714 - Thanks to the Down Payment Assistance Program they only paid $1000 deposit + $300 inspection (optional) + $485 appraisal + $39.48 at closing

— Jose A Loret de Mola and Danay Garcia

Congratulations to Jose A Loret de Mola and Danay Garcia for the purchase of their new home Saint Petersburg, FL 33713 - Thanks to the Down Payment Assistance Program they only paid $400 deposit + $485 appraisal + $14 at closing

Frequently Asked Questions

What documents do I need to apply for a mortgage?

30 days of pay stubs, latest 2 years of W-2s, or, if self-employed, 2 years of tax returns.

Latest 2 months of bank Statements.

How long does the mortgage approval process take?

The mortgage approval process can vary based on several factors, including the type of loan and your financial situation. Generally, it can take anywhere 30-45 days. We strive to make the process as quick and efficient as possible. NOTE: The City may take up to 60 days.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has a constant interest rate throughout the loan term, while an adjustable-rate mortgage (ARM) has an interest rate that may change periodically based on market conditions.

How do I know how much I can borrow?

Your borrowing capacity depends on various factors, including your income, credit score, debt-to-income ratio, and the type of loan you are applying for. Our team can help you assess your financial situation to determine the right amount.

Does this website belong to the City of Saint Petersburg?

No, this website belongs to Generation Mortgage Associates, LLC. The City of Saint Petersburg does not work directly with buyers. At Generation Mortgage Associates, LLC, we are an experienced mortgage company specializing in providing FHA and Conventional Loans, paired with Down Payment Assistance Programs.

Thank you for choosing us. We are dedicated to helping you achieve your homeownership goals with personalized service and expert guidance. For more information or assistance, feel free to reach out to us anytime!

Gallery